Germany: Impact of rising yields on IFRS and HGB pension disclosures in 2022

Author: Rainer Bannör, Lurse

After years of historically low interest rates, the year 2022 has brought a turnaround: interest rates have risen significantly. This also has consequences for the discount rates used to determine the balance sheet values of pension obligations. This is because they are based on the market yields of corporate bonds with very good credit ratings (AA rating) and long maturities. At the end of September, however, these yields were about 2.75 percentage points higher than at the end of 2021.

Depending on the accounting standard, this change has a different impact on the actuarial interest rates for pension obligations:

- For the HGB balance sheet, the discount rate is the average of the market interest rate level over the last 120 months. This average value has fallen steadily over the last few years. At times, the decline amounted to up to five basis points (0.05 percentage points) per month. Since the interest rate level in 2012 was similarly high to that of today, the average value is hardly changing at present. So the decline has stopped. Should market interest rates remain at the current level, it will nevertheless take time for the HGB discount rate to rise again: At the end of 2022, an interest rate of 1.79% is to be expected, which would even be a slight decrease compared to the end of 2021 (1.87%). A noticeable increase is not expected to set in until the end of 2024.

- In international accounting according to IFRS or US-GAAP, the discount rate is based directly on the market level on the balance sheet date. This is currently usually about 2.75 percentage points higher than the interest rate on 31 December 2021.

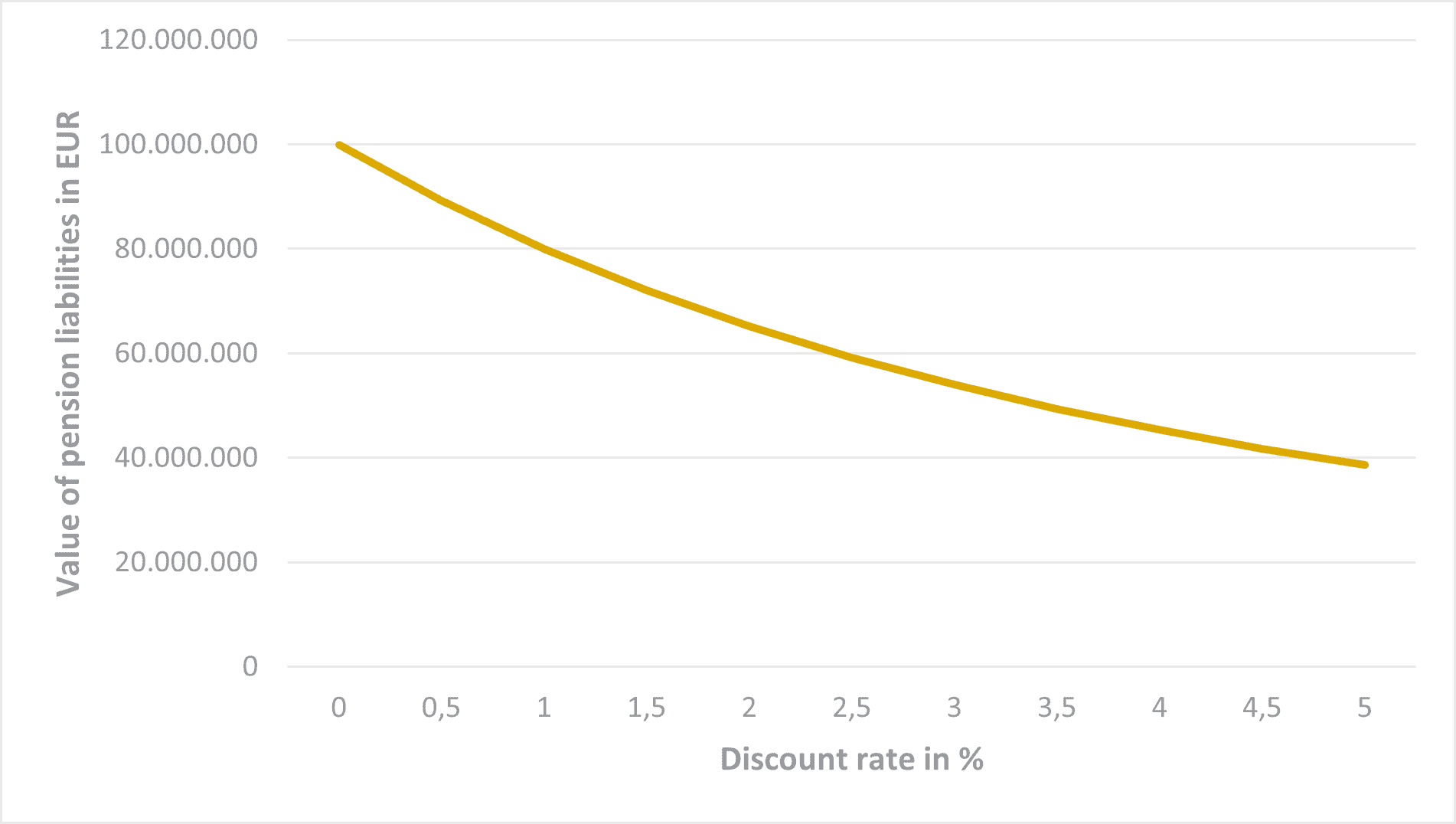

Due to the long maturities of pension obligations, the discount rate is the parameter with the strongest influence on the size of the balance sheet obligations. This is illustrated by the following example: for simplicity, let us only consider a single annual pension payment of EUR 1,000, which is due in 20 years’ time. We will ignore biometric assumptions. In the balance sheet, the employer must set aside the amount that he needs today, applying the discount rate, to be able to pay out this pension in 20 years. If he can count on an annual interest rate of 1%, this amount is around EUR 820. If, on the other hand, the annual interest rate rises to 3%, around 550 EUR will suffice. In our example, this corresponds to a decrease in the required balance sheet provision by EUR 270, i.e. by about one third.

The precise effect of the discount rate on the amount of the balance sheet obligations depends on the design of the specific pension commitments of a company.

Example for a typical pension plan

Source: Lurse

The effect of changes in the discount rate can be estimated very roughly, but easily, if the remaining term (duration) of the specific obligations is known. This can usually be found in the notes to the international financial statements. Multiplying the remaining duration by the discount rate difference gives the approximate percentage change in the size of the obligation. An increase in interest rates leads to a decrease in obligations and vice versa. An example: If the interest rate rises from 1% to 3% and the remaining term is 25 years, the scope of obligations is reduced by an order of magnitude of (3% – 1%) x 25 = 50%. However, the greater the change in interest rates, the less accurate this estimation method is.

Effects on the balance sheet expense

Insofar as the decrease in the extent of the obligation is a result of rising interest rates, it is recorded in the international balance sheet with no effect on expenses. In HGB accounting, on the other hand, it is recognised as an expense.

However, the increase in the discount rate does not only affect the amount of the obligations. The current annual expense is also affected. It is made up of the service or personnel cost and the interest cost. If the discount rate rises, the present value of newly acquired pension entitlements falls and with it the personnel expense. The interest expense can be seen as the required return on the provision. It thus corresponds approximately to the extent of the obligation multiplied by the actuarial interest rate. This means that if the actuarial interest rate increases, the interest expense can also increase significantly. Some companies that prepare their accounts according to IFRS or US GAAP will therefore have to report a noticeably higher total expense in the next financial year. However, this effect depends heavily on the composition of the liability portfolio. A significant increase in expenses is to be expected, for example, if all beneficiaries are already drawing their pensions. In this case, there is no relieving effect from a decrease in personnel expenses. In addition, the short remaining term of the obligations means the interest expense rises sharply in percentage terms.

Conclusion

Rising interest rates have hardly any effect on the HGB balance sheet in the short term. In international accounting, on the other hand, there are considerable effects on the size of the obligations and expenses. While the value of the obligations already decreases in the financial year of the interest rate increase, the expenses only change in the following year and can also increase significantly in the overall view.

However, due to the large price fluctuations on the bond market, it is currently difficult for companies with a balance sheet date of 31 December to predict the extent of the interest rate change compared to the previous year’s financial statements. The largest monthly changes in the discount rate level recently approached a whole percentage point. This included a strong interim decline in July. Further swings in both directions are therefore possible before the end of 2022.